The Golden Tax is one of the pieces of legislation that companies with operations in China need to comply with.

In this blog, we will discover what is the Golden Tax and how Oracle ERP Cloud addresses this requirement.

What Is the Golden Tax?

The Golden Tax is an integrated nationwide value-added tax, integrated value-added tax (VAT) monitoring system that all businesses operating in Mainland China are required to use to issue all VAT invoices, VAT Calculations, and statutory tax reporting. If your organization is a VAT-registered entity, you will have to generate your physical invoices through the Golden Tax System in the format mandated by the Tax Bureau authorities. So not using the Golden Tax System is mandatory.

According to Tracy Zhou, CEO Acloudear, in an interview with United VARs: “to put it simply, the GTS is made up of two terminals. One belongs to the tax authority and the other is located at the company. When a transaction occurs, the company issues an invoice to the buyer and, through the GTS, a copy of it is sent to the tax administration. The authorized officers make sure that the output and the input VAT invoices match. If the invoices match, they are correctly validated and then given a unique number. This system was designed to have anti-counterfeiting and controlling functions.”

If you need more information on the Golden Tax you can check out the State Administration of Taxation website.

How Can You Make Your Invoice Generation Process With the Golden Tax Requirements?

Even though some companies still use a manual VAT invoicing method, which requires a lot of paperwork, there’s some third-party solutions and systems that can transfer the VAT invoices information from the ERP software to the Golden Tax System but for companies using Oracle ERP’s (On-Premise or ERP Cloud), there’s a solution called Oracle Golden Tax Adaptor.

How Does Oracle Golden Tax Adaptor Works?

The Golden Tax Adaptor provides integration between Oracle Receivables and the Golden Tax software system. The Golden Tax Adaptor manages the conversion of Receivables transactions to VAT invoices for China and integrates with the Golden Tax software provided by the Aisino Corporation, the leading provider of Golden Tax software to Mainland China. Together they manage the processing of Receivables transactions for the Golden Tax system for China.

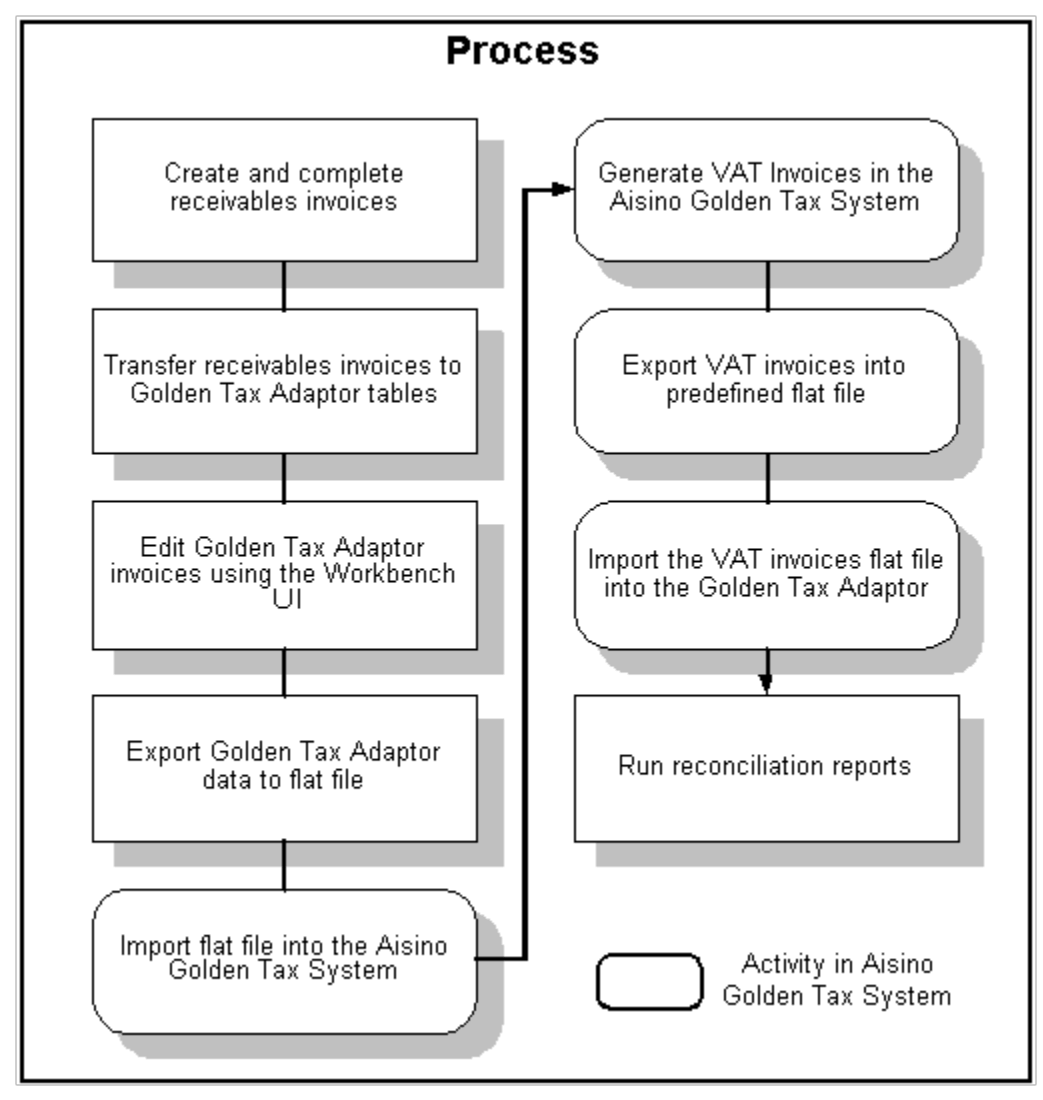

Golden Tax Adaptor Process

The key processes for a typical workflow are:

- Create receivables invoices manually or by using auto-invoice.

- Transfer receivables transactions to the Golden Tax Adaptor.

- Manage the data in the Adaptor using the Golden Tax Invoice Workbench.

- Consolidate multiple invoices to an invoice based on the Consolidation rule.

- Export the invoice information either from the Golden Tax Invoice Workbench or a separate process.

- Import the flat file into the Aisino Golden Tax System (perform this activity in the Golden Tax software.)

- Generate corresponding VAT invoices in the Aisino Golden Tax System (perform this activity in the Golden Tax software.)

- Export the VAT invoice information from the Aisino Golden Tax System (perform this activity in the Golden Tax software.)

- Import the VAT invoices data file back into the Golden Tax Adaptor.

Doing Business in China

The Golden Tax System is just one of many legislations that make business in China challenging for foreign companies. IT Convergence IT helps clients roll-out their ERP Softwares overseas. Our approach leverages a mix of local business experience, exposure to multinational reporting requirements, and ERP best practices, to help ensure the solution you implement meets your success criteria both locally and globally.

Read more about our Global ERP services.